Owner of Nothing

- E Chan

- Jan 14, 2022

- 24 min read

If you don’t understand a company and where its money is going, you should not own it’s stock.

Yet millions of shares are doled out to employees who don’t care to know how the business is doing. Despite never having read an annual report, they talk about the business they work for as if they have a clue about how it is being run. At best, they parrot whatever management tells them without proper due diligence.

This is an utterly ridiculous arrangement and is completely self defeating for both the employees and businesses.

The current belief is that if you compensate employees with company stock, they will act as owners of that company. Therefore, it will be in their interest to make the stock price go up by producing real value for the company. They will care more about their own work compared to if you had compensated them with cash.

At least that’s how it’s supposed to go.

The reality is far from that and both management and employees will get the shareholders and business they deserve. Short term thinkers hire short term thinkers and the consequences of this is an atrocious cycle that destroys the value of the business. But that also means long term value building businesses and leaders will attract long term value oriented employees and shareholders.

So let’s talk about why stock compensation for most employees is not only pointless but also completely detrimental to the business itself. If anything, the current treatment of RSUs is a complete joke and only serves to hurt the business in the long run, especially if it hires the wrong people.

This letter started as a simple warning of rewarding short term thinking employees with stocks. But I encourage you to take multiple reads of this to understand if management truly has your best interests, especially if you are not well versed in business. The musings and warnings just might apply to your own situation as well.

Better To Be Loyal And Valuable Than Well Paid

It's no secret that the more senior you are, the higher percentage stocks make up your total compensation. These stocks are granted to you in chunks over 4 years with an initial lion’s share granted up front. And many employees see this as the magical lottery ticket to getting wealthy.

For the sake of this section, we will consider FAANG and other tech companies that copy the compensation structure. This discussion doesn’t really apply as much to someone who’s equity compensation is less than 10-15% of their total compensation (ie. working at a midwest mom-and-pop company as their sole backend engineer). But this exercise is useful nevertheless to show that your compensation over time doesn’t matter if you are able to get promoted.

In theory, should the stock stay sideways and not move and your performance/bonus doesn’t change, then the total compensation year to year will remain relatively the same. Assuming a stock price moves sideways, if a person makes $200k base and $400k RSUs vesting over 4 years, he will make $300k per year. Add $100k refreshers ontop of that per year and you can easily hit $400k.

In reality, the price action of any stock can change erratically for any reason. One year, it can be up 50% and in the next, down 60% for completely external reasons outside of the company’s and employee’s control. But over the long run, say 5+ years, the stock should correct and return to its true intrinsic value and the deserved rate of return. Barring any freak surprises from macroeconomic conditions.

The short term tax consequences can be a nightmare (vest high, sell low). But that's for another day.

The problem is that at first glance, the vesting cliff of these RSUs encourages a sort of gamesmanship of stocks. That is, because a huge amount is vested at the beginning, the only way an employee would stay on is if the to-be-vested RSUs no longer match what an employee could get elsewhere. This can be a problem if the stock has had a steady march downward. For instance, imagine what would happen if an employee joined at the peak of the price history, the price drops 50%, and the employee was never compensated for that.

Heck, even in this situation, an employee would have a very strong incentive to leave before all the shares have vested. At least you might think so, right?

Let’s do a few examples. The sheet that I am using can be found here. Feel free to torture the data and see what you come up with.

Let’s suppose you join a terrible company but were looking at a market-average one. One company grows at a market rate of 10% year over year and another company shrinks by 20% yoy. And for the sake of evenness, suppose both companies give you the same amount of stock each year.

At the end of year 4, the cumulative compensation difference is 300k. That’s somewhat significant but its not life changing amounts of money. Especially after taxes.

Where it starts to hurt is at the end of year 8 where your cumulative lost total compensation is just under double your annual compensation at about 650k or so.

However, if you were to get promoted, the entire dynamic changes. In fact, getting promoted in 4 years at a company is literally the best way to not just close the gap but to beat it as well. It begins to widen the gap and your compensation will begin to outpace that of a market growth company. Even if that company does poorly. In this average example, you will make about 200k on average more in 8 years by getting promoted at a bad company than staying at a good company.

But say you disagree though. Let’s suppose you are dead set on finding the next “hyper growth” 30% year over year company and you firmly believe that you can pick one out.

For one, this endeavor for most people is very fucking stupid. People are very bad at picking and choosing stocks for investments in general and they’re treating the company they work for like an investment. Its actually equivalent to yoloing half of your net worth on a single stock.

Furthermore, by the definition of market average, the returns that people on average see are going to be at the market average. So not everyone can score a winning unicorn ticket. And the people who consistently beat the market with those 20-30% yoy returns are so rare they deserve their own discussion. At this rate, you would have to believe a company can expand 8x its market capitalization. Keep in mind though that only a handful of companies on this planet could achieve 30% YoY growth for 8+ years. The fact that you know them by name and can count them on both hands is a testament to how rare they are. Like Warren Buffett.

But let’s look at the results anyway. Keep in mind we are comparing the best most wonderful case scenario to the worst case one.

Assuming no promotion and 30% YoY growth for 4 years, you miss out on $500k which is about 1.5 year annual salary. Not terrible but it does sting.

Bringing this 30% growth for 8 years, you miss out on $1M of total earnings. Ok, this definitely hurts.

But assuming a promotion, your missed earnings just becomes $200k or so in 8 years. An almost negligible difference, especially compared to the fact you’ll only miss out on $350k at year 4. This means that the moment you get promoted, your compensation will be roughly equal to that of a 30%+ YoY company at a lower level.

This also explains why FAANG tends to downlevel applicants and prove them less stock. For one, the projected compensation at FAANG tends to be more predictable than a company nobody has ever heard of. FAANG has tended to follow a very high 30% YoY stock price growth and has the historical track record to show for it.

Over the length of your career of 10-15 years, $350k is negligible. If anything, it becomes easier to get a higher position at FAANG simply by getting promoted elsewhere and coming back. And for that small difference in salary between working at a decaying company at a higher level and rest-and-vesting at a hyper growth company, it seems incredibly stupid to try and game the stock market and switch jobs frequently. This job hopping actually destroys your career progression as there is friction in performance: learning a new codebase, new team, and most importantly, re-establishing your professional relationships.

In other words, in the absolute worst case scenario where you never sell your shares, joining a hyper growth 30% year over year company is just as good as joining a non growth company at a higher level and thus compensation. The only way you lose in the total compensation game is if you have no future at your current company and no chance of a promotion.

Why you would gamble on something out of your control like the stock price rather than your own skill and merit for your financial wellbeing is insanity. Yet that's the attitude most people have.

This paints 2 very clear pictures.

First, on average, it's simply better to stay with a stable company that is moderately growing instead of gambling on a potentially subpar company (which most companies out there are). The chart shows that, on average, you only miss out on 1 year’s salary worth of compensation over the course of 8 years if you land at the wrong company.

The second is that it's almost always better to bet on yourself. A promotion in 4 years will yield a better return than making no progress at all in your career. Your compensation will completely outpace a rest-and-vester who does not care and at worst, be relatively even.

Jumping around is a viable tactic only for those who cannot progress and improve themselves. I am a firm believer that if you are valuable that someone will pay you what you are worth without the need for tricks or bullshit like gambling on interviews. To believe otherwise would imply that a majority of the results are highly dependent on luck. While this is true to some degree, it renders the whole idea of actually trying to improve moot. A topic which I’ve addressed in other letters.

Again, why the hell would you gamble your financial well-being on something out of your control?

Third, if you are a rest-and-vester and have no desire to improve your career, then staying long at one company is better than hopping around. Let compounding do its thing because you will pay a friction for selling.

Because, as a bonus, the not-obvious picture is that if a stock is that truly beaten down over 8 years, then it will be worth only 16% of its peak value. At that point, as long as the business has real intrinsic value, continues to be profitable, continues to grow its revenue, you should be frothing at the mouth to work there. Assuming the peak value was its fair market price, wouldn’t you want to work for a company that would explode to 5-6x its current valuation in a few short years? That’s literally a multi-bagger investment that few people can dream of right there!

This is why I always tell people to constantly improve their skills and grow their careers. Not only are most people absolutely horrendous and inept at predicting prices and timing the market, it is the best way to ensure high compensation with very little downside.

Thus, we have (somewhat) dispelled the myth that, on average, it is better to switch companies every few years. This is only believed by people who do not believe they can get promoted, cannot increase their inherent value, or want to gamble on a company like its a lottery ticket. Usually some combination of the 3.

Like I mentioned in the beginning, there are extenuating circumstances where if your compensation is not significantly made up of RSUs, then this observation is not as applicable to you.

Nevertheless, it is simply better to seek stability and loyalty and improve one’s self. As long as you do this, even in the worst case where a company refuses to promote you, as long as you have the skill, you will be worth that in the open market.

Most Employees Do Not Care

So if the mathematics proves it doesn’t matter too much what company you work for if you only plan on staying there for 4 years, then why make a lateral switch only for the money? Most of the real gains come from sticking with a company for the long run and from getting promoted. Why not just invest your time and energy into yourself and play the long game instead of buying lottery tickets to the next unicorn?

Let me answer my own question: most people can’t put in the proper work or effort to improve themselves for reasons outlined in my last letter. To them, their job is just a job, not a craft that they can get better at. All they are used to doing is copy-pasting code and think that is engineering. And this shows in how they treat the company they work for.

Most employees do not act in a way that shows they care about value, the long term health of the company, or their own careers.

One manager I knew gave a great speech about how she wished she stayed with companies longer. Right before she decided to go to another company whose stock price would get decimated to 20% of its peak value. That’s right: the stock dropped 80% after she started.

And had I looked at her average work history on her LinkedIn profile prior to starting, I might have predicted the hypocrisy a bit sooner. I wonder if I should reach out to her and ask how she’s doing and if she actually listened to her own speech.

I’ve been fortunate enough to learn the lesson that the attitude one has in one part of their life will carry over to the other parts. If you are inclined to throw a hissy fit and quit in the middle of a Dota game because things don’t go your way, then you are also inclined to do the same in real life to some degree. In psychology, we call this “attitude behavior consistency” or you might hear this as the behavior cycle where action, emotion, and belief all rise to meet each other.

I’ve touched on the engineering side of this in my last letter: how most engineers are code monkeys and think nothing about the long term health of the code base. But I want to address the business side in this one. That is, most employees don’t think about the long term well-being of the company. If we are to believe the attitude behavior consistency principle, the engineers who don’t give a crap about their careers are not inclined to give a crap about your company, especially when doing better at their job helps the company’s bottom line.

But I want to dive into this a bit more and hammer this point home not just with personal anecdotes but with facts and examples in the wild.

Let’s look at some threads to see how employees talk about and think about their RSUs. From Blind:

“You already get a bonus that is partially based on company performance. And you are forced to hold RSUs until vest in company stock. Once the stocks vest you can invest in other high growth stocks (e.g. Amazon/Apple/Tesla/etc) or index funds so you’re better covered if FB stock were to suddenly drop.” Aug 18, 2021

Just sell and diversify for index funds makes sense: after all, we do want some downside protection in case we are wrong. But bet on other companies other than your own? Would you want a guy who buys shares in his competitors to run a company? How about Hacker News? Hopefully they are better.

2) Unless you're a C-suite exec, your actions will likely have no direct impact on the stock price. And obviously, insider trading is illegal. That means holding your own company's stock has no fundamental advantage over holding stock of a company you don't work for. If that's the case, you're better off picking stocks based on actual performance and eliminate the personal bias.

They talk and speak as if it's just an inconvenient way of being paid and they have no impact on the bottom line. They sound like real business owners to me!

The statistics don’t change the tune either. Let’s look at one quote from the National Association of Stock Plan Professionals:

A criticism I frequently hear about ESPPs is that employees “flip the shares,” meaning that they sell the shares they acquire under the plan almost immediately after each purchase. But nothing could be further from the truth. Almost two-thirds of companies (63%) that offer qualified ESPPs report that participants hold the stock acquired under their ESPP for an average of one year or longer.

Wait, that means that at 37% of companies, people on average hold onto the stocks for less than a year. And that’s through the ESPP which are OPTIONAL to opt into: where employees WANT to and have an incentive to buy into the company! Would you want to give stocks to someone who liked your company and you knew he had a 37% chance of dumping your stock?

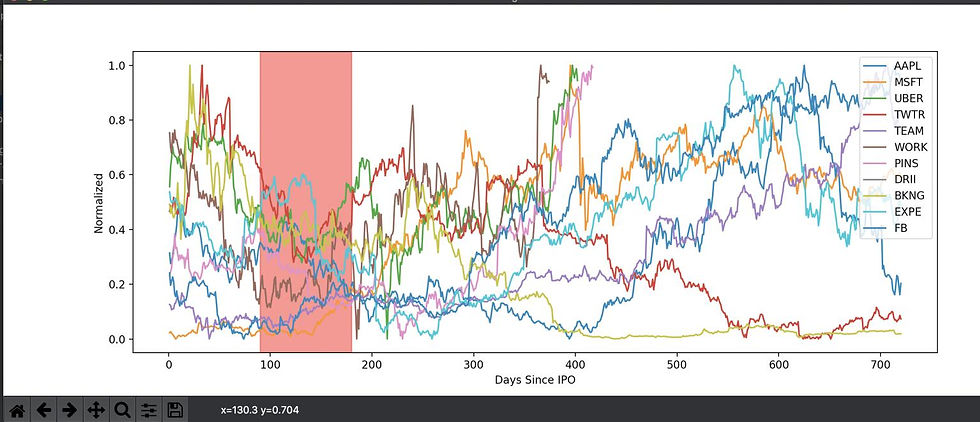

Let’s look at some historical behaviors as well. Here are the normalized price values for various tech companies for 700 days after the IPO. I’ll post the script as well so you can play with the data as well.

You can clearly see that there is a significant drop in price between days 90 and 180. This can only occur if there are significantly more sellers than buyers during this time. Now, what group of people would have the opportunity and incentive to sell all at once during this period?

If we consider that a lockup period, a time period where employees cannot sell company shares, expires 90-180 days after IPO, then the picture becomes clearer.

Not only does the price decline, it declines an extreme amount, almost to half its IPO price. To move the market price this much, there would have to be almost double the number of sellers as there otherwise would have been.

While correlation doesn't equal causation, it's very funny how the decline in prices coincides with the first moment employees get to sell their shares. And this trend is true across many companies. What group of people could hold this many shares to move the market when the daily volume is in the millions of shares? Maybe the institutions that helped the IPO but they could sell before the lockup period themselves. But come on, let’s be real for a second here.

Funny how employees are supposed to be the same people who poured their blood, sweat, and tears into a risky company just to give a large portion of it to someone else without a care in the world. And they call it a win.

It’s about as dignified as raising a child for 18 years and marrying them off to a complete stranger just so you can get them out of your house and say you did a good job as a parent.

Unfortunately I could not find the exact statistic of the percentage of employees that sell their RSUs within 1 year. But with the modern zeitgeist to sell shares immediately upon vest for diversification, I believe we have established a reasonable baseline for employee’s general lack of care. Hopefully this evidence shows you that employees do not consider shares in the businesses they work at meaningful.

Why Would Management Give Shares Anyway?

Keep in mind that management are also employees. Most also don’t see themselves as business owners either. As a result, they too are short sighted and fail to understand or value the long run impact on a business. If anything, management prefers short term thinking because of the litany of tools at its disposal, especially for handling situations where employees continually dump their shares. If we look at all their options, the use of RSUs for compensation is almost completely in favor of management. All signs point to the fact that RSUs are a tool for management to underpay their employees.

There are 3 ways for a company to transact with their own stocks whilst still retaining value: either the seller of the stocks thinks the stock is overvalued, whatever they are obtaining (ie. price of labor ) is undervalued, or the seller of the stock will buy back the stock if the employee sells it should it be undervalued. Even if the employee holds the shares, it is still a great deal for the company.

Of course, all this assumes that price and value do converge at some point. Which they do in the long run. Not even Gamestop can stay at $300 a share forever.

Let’s illustrate this situation.

A software company pays their employees with stocks. The company believes that the value of the stocks is $10,000 a piece. But the employee mistakenly believes that they are worth $20,000 because he can sell it on the market for $20,000. Therefore he is indifferent to being paid in a share or $20,000 in cash. In this scenario, the company has every incentive to give the employee stock because, in their eyes, they have paid the employee only $10,000.

Or maybe the employee is offering their work at a bargain at $10,000 when the company gets $20,000 of value from the labor. The company would gladly pay $10,000 worth of stock to obtain that $20,000 of value.

Finally, should neither of these scenarios apply, the company would gladly rebuy back the shares if the price is right. Suppose that in the above example, the employee sells his $20,000 shares that are really worth $30,000 in value. The company would gladly take the other side of the trade and recapture that value in case it overpaid the employee.

Even if the employee ends up being the rare faithful believer and holds onto the shares, that’s also in the company’s interests. With less people selling shares on the market, there is less supply. With less supply, the price must go up. The company’s market cap looks great and the executives are dancing on the rooftop with their wonderfully priced stock options. Even if the shares are undervalued, its still in the hands of people who would likely remain faithful to the business.

No matter what happens, the company cannot lose by paying in RSUs. At worst, they will be paying market price for labor. At best, they will save a few bucks. And in the middle, the cost is bore by the people they’ve successfully lulled into believing in the company.

Management in theory should have a responsibility to protect these shareholders. But they have every incentive to not and have tools to protect their bottom line for the quarter. And we have seen many times in corporate America where this is the case.

“I get that this is personal for you but we have a fiduciary responsibility… No we don’t. Nobody is acting responsible. Fuck responsibility! Are you kidding me?” -Mark Baum (2015)

Who Does It Hurt?

So what is the harm in employees not acting like a business owner and dumping the shares? Employees are trying to follow the prescribed path: play it safe, sell the stock, get the cash, invest in an index fund, and retire in 30 years.

In order to accept this, you first need to accept that they do not act like business owners. I don’t know what business owner sells shares of his business every year to pay for his lifestyle. If you find one who does this, please send me an email with his information along with the average lifespan of his businesses.

Most business owners I know funnel 90% of the cash back into the business to grow it, take a small portion for themselves, and treat equity as sacred.

The problem with employees dumping shares is that this short term behavior fucks long term shareholders. AND I MEAN ROYALLY FUCKS. Effectively, it hurts the most dedicated employees and rewards the least dedicated one. Most importantly, if we are to believe “attitude behavior consistency”, these most dedicated employees are probably the most effective employees who believe in long term value.

Why is this the case?

Let’s consider the type of shareholders a business would ideally want to have for a business. The best type of investors and shareholders a company ideally wants are long term investors who believe in the long term mission of the company and want to help create value for that long term mission.

Only extraordinary circumstances (ie. solvency issues) should dictate that a company should want short term investors as they will demand share price growth at unreasonable levels. The pressure to do so encourages unscrupulous behavior on the part of management to meet these demands, including sacrificing the long term health of the company.

Having the best shareholders to answer to will make making good and profitable decisions so much easier. Creating value and rewarding the faithful: that should be any company’s mission. That’s simply good business.

So then how does the short term thinking and sale of stock and RSUs conflict with this?

Let’s consider what happens to the stock after the employee sells it, which they most likely do. Because of the auction driven nature of the market, the stock price will likely fall because the highest bidder now has a share. The second highest bidder’s price is then used to set the market price and by definition, it must be lower than the previous sale.

The existing shareholders just lost value on their stocks because someone is selling. And as long as people continue to sell, it puts downward pressure on the stock. It's basically bag holding while everyone else decides to dump.

This fundamentally tests the long term shareholders who have all the care of an owner but none of the power, especially when they are just an employee who sees C-suite and Senior leadership as the captains of the ship. It's hard to hold onto a stock after watching it decline and when everyone in your company is dumping. It is human nature to follow the herd and eventually, even the strongest hands will capitulate and take the worst price for the stock. Usually, these strong hands belong to the people who care the most who, per the initial premise, were supposed to be the ones who care about the company the most!

Congrats management. You’ve decided to fuck the people who care the most about your company in order to appease the employees who don’t give a flying fuck at all.

How can you look employees in the eye and ask them to be shareholders when you don’t even value their investment and most of all, value their trust? But hey, feel free to blame the shareholders for not believing hard enough when you do nothing to protect them. See where that gets you.

Everyone Loses

I want to make this very clear: the management and employees are different from the business. The management handles the operations of the business. The employees build the goods and services. But the business is the exchange of those goods and services and the company is the entity that engages in those transactions.

And in the long run, if enough operators only focus on short term thinking, the business and company suffers.

If the management does not protect the long term shareholders, nobody will be willing to buy unless the market hypes up the stock. At that point, the only true shareholders are the short-term whims of a drunk crowd and greedy employees who are ready to cash out at any time.

This will make it harder for the company to raise capital and achieve any kind of stability since every time a share is transacted, a fee must be paid to a financial institution. That fee comes out of the company’s equity, not the buyer, as the buyer has factored that into the price.

In other words, its harder to scale, harder to conduct business, and the business pays a portion of their value year after year to financial institutions and gets absolutely nothing in return. Compounded over time, that can be a lot. If we take the standard 2% for fee transactions, then in 10 years, the company would have surrendered 20% of its value for nothing.

Seems like a shitty way to conduct business to me. Any company that loses 20% of its business for nothing of value because it decided to act immorally is a business that deserves to go bankrupt.

Not to mention, you are putting shareholder powers into the wrong hands. As a shareholder, you are entitled to vote on the board of directors who then vote for the CEO. Its one thing when a group of rational people engage in a democratic process to vote for their own business interests. Its another when a bunch of greedy emotional uncaring short term thinking lunatics do it.

What kind of management will those people vote in? They will just pimp the company’s long term visions for temporary stock price boosts to cash out.

For instance, one investor is calling for the CEO of Peleton to be fired because the company failed to be acquired when it was significantly overpriced. Excuse me? You are mad because someone else didn’t overpay for a company? Or if you sincerely believe it is worth $50B, you should be buying more now at $8bn. Clearly, this man is not an investor any business would ever want to have. But this is the kind of person a business resigns itself to when all it attracts and wants is short term thinking. Imagine having a bunch of his clones making and designing your products. That’s effectively what giving RSUs to most employees means.

Finally, consider your employees themselves. Incentives are powerful and trying to give stocks to employees who don’t care effectively rewards short term uncaring employees at the expense of the core long term ones. Management will focus on hire new employees with better stock compensation packages in an effort to attract talent. But that dilution decreases the value of stocks held by existing shareholders.

Remember the idea of “action behavior consistency”? If management has no reason to want long term value, they will keep their actions across the board consistent. Not just in shareholder compensation but also in their engineering priorities.

From an engineering perspective, this creates a huge drag. The core team that cares no longer sees long term support from management. They see the huge amount of stock that newcomers get that is worth more than their current holdings. Holdings that they had to risk everything and work 12 hours a day for 6 days a week for. So they give up and quit. Knowledge is lost, the code base quality drops, productivity declines, and morale decreases as the people who care the most have to clean up all the crap left behind.

In other words, the cost is hidden but is paid in spades in the long run. If we consider lost developer productivity into the equation, this cost can run up to 30% of a company’s long term value. An engineer who cannot get the answers to the architecture will spend 20% of his time retreading trying to recover lost knowledge that a senior engineer that left knew. Stack that on top of the 20% premium paid for employees dumping. And finally, factor in the long term damage from short term stock-price boosting behavior like overpaying for acquisitions.

Suddenly, the long term picture doesn’t look rosy.

Closing

“All I Want To Know Is Where I'm Going To Die So I'll Never Go There” -Charlie Munger

So let’s quickly recap: employees tend to dump their shares, fuck over the long term shareholders, and management has a lot to gain by feeding the lies to people who care the most. Because those people will foot the bill and lose.

Yet for employees, the most optimal way for them to secure the biggest paycheck is to simply stay at the company and show loyalty to a management that may not actually care about the business at all. The employees hold the biggest bag since the stocks do not vest until much later into the future. And the only way for employees to financially recover is to get promoted.

Its a very ugly situation and to me, if a company wants to retain quality engineers, they can start by taking away RSUs from people who don’t care. These people just want cash anyway and never cared about your business or the quality of their work from the start.

A great parabole by Warren Buffett illustrates this:

“A fellow was on an important business trip in Europe when his sister called to tell him that their dad had died. Her brother explained that he couldn’t get back but said to spare nothing on the funeral, whose cost he would cover. When he returned, his sister told him that the service had been beautiful and presented him with bills totaling $8,000. He paid up but a month later received a bill from the mortuary for $10. He paid that, too – and still another $10 charge he received a month later. When a third $10 invoice was sent to him the following month, the perplexed man called his sister to ask what was going on. “Oh,” she replied, “I forgot to tell you. We buried Dad in a rented suit.”

How many rented suits are in the codebase today because management improperly rewarded short term thinking engineers?

But I also think it's terribly cynical to treat every company as a selfish short-term thinking ponzi scheme. Rather, I think it's more helpful to try and work for companies that have long term shareholder interests in mind, especially if you plan on working there for a very long time.

So how can we as employees find great companies to work for?

The first sign is if management is truly protecting shareholders by looking at how executives act and behave. Do a background check on the C-suite executives at a company and recognize that what they have done at one company, they will probably do at another company. Look at what happened to the companies at each of the times under their watch and assume that the business value that was created there will occur at your own company.

Tangential to this is how executives are compensated, especially compared to employees. Some executives do some pretty horrifically abusive things like firing before vesting to screw over their employees. Even the existence of stock options for executives and the ability to reprice them at will is pretty horrifying in how easily it is abused. In short, this practice encourages boosting short term gains and the stock price, exercising the option, and then when the stock falls again, reprice the options lower and repeat. All at the expense of long term value

I honestly think that if you look at some of the highest performing stocks and companies, you can see how their management treats their employees and compare it to your own. Coca Cola, one of the longest living, most profitable, and most stable companies in the world that routinely outperforms the market announced plans to link executive pay to company employees to make the compensation more equitable.

So frequently check Finviz or other insider trading tracking platforms to see what executives are exercising, buying, and selling. Insiders will sell for a variety of reasons and if many are selling, then chances are many of them know something. Be especially leery if executives are dumping.

But companies buy only for 1 reason: that the stock price will go up or is undervalued. If you see a company that buys back its own shares, that’s a bright green flag.

The second is to question what management says about their own report. Keep in mind public filings are meant to be a honest way for management to tell shareholders about their own company and to provide guidelines that help make the report more easily understandable in the context of the business. The auditing company is just there to make sure no laws have been broken.

But this is akin to asking a basketball team to keep track of the score versus their opponents. Don’t readily trust the report of someone who has a lot to gain from deception. If something is off or not clear, that’s a good sign management wants to hide something.

Finally, the attitude of the people who work there is the biggest sign. You can generally tell what kind of people the company is hiring based on the sales pitch the recruiters give you. If the company is trying to convince you with compensation number and stock projections (let’s face it, nobody can predict stock prices more than a few months out), then they are going to get short-term thinking employees who only care about the share price.

Check your company’s Slack Channel for whether people are talking about money or product quality. Better yet, check the average tenure of people who work at the company. A high turnover is not a great or encouraging sign.

But if you can find a company who pitches you on the quality of the projects and people and the pay is fair, I think its a wonderful company to work for in the long run.

Like I said, every company gets the employees and shareholders it deserves. And every employee gets the business they deserve. No amount of money can compensate for working with a bunch of failures and lazy morons who don’t care. You will lose your mind quicker than the money is coming in.

For those who are looking to rest-and-vest and not increase value for the company you work for, you do not deserve to get cash and prizes. Please just stop demanding more than what you deserve. You’re just ruining it for the rest of us who do care.

So managers, please take away stocks from people who just don’t give a shit. They’re just hurting your bottom line and the long run. Paying 1% of your total equity per year to employees doesn't seem like much. But over time, it will add up and eventually you will pay the price when you wake up one day and realize you wasted 10% of your business's value on nothing.

Comments